Today's Tech Check- "IvyCap Ventures Raises, RBI Urges Measures on Gold Loan Disbursals, Govt and Fintech Tackle Cybersecurity, Mahadev BettingApp Investigation update & April UPI transaction analysis

1st May, 2024

“🚀 Dive into the latest buzz with Newstok! 📰 Get ready to fuel your curiosity and stay ahead of the curve with our exclusive newsletter. From hot industry trends to expert insights and insider tips, we've got you covered. Join our vibrant community of knowledge seekers and embark on a journey of discovery. Don't miss out – subscribe now and unlock a world of valuable content with Newstok!"

1. “IvyCap Ventures Seals Third Fund at a Whopping Rs 2,100 Crore to Fuel Startup Dreams - Unveil the Full Story”

IvyCap Ventures Fund Closure: Mumbai-based IvyCap Ventures closes its third fund, Fund III, at Rs 2,100 crore.

Funding Details: The initial corpus was Rs 1,500 crore with an additional Rs 600 crore raised through a greenshoe option.

Investor Base: According to Vikram Gupta, founder and managing partner, most funding came from existing investors with 90% being domestic capital.

Investment Strategy: Plans to invest in approximately 25 Indian startups primarily at the Series A level, with investments ranging between Rs 30 to 50 crore per company.

Sector Focus: Although sector-agnostic, the firm is focusing on AI, IoT, and machine learning among others, having already committed 40% of the fund across seven companies.

Follow-on Investments: Allocates 20% of the fund for follow-on investments in existing portfolio startups.

AUM Growth: With Fund III, IvyCap Ventures’ AUM reaches approximately $600 million (Rs 5,000 crore).

Market Position: Enhances IvyCap’s influence in technological and business innovations within India.

Long-term Impact: Targets sectors like consumer, health, fintech, B2B SaaS, space, and climate tech startups; aiming for significant ecosystem developments.

#Market #Startup #business #startup #innovation #AI #funding #News #company #crore #Article #health #innovations #machine learning

2. “RBI Raises Alarm: Urges Banks for Corrective Measures on Gold Loan Disbursals Through Fintechs”

RBI warns banks against gold loan disbursals through fintech startups, citing concerns over the evaluation process and gold sourcing.

The regulator has demanded immediate corrective actions from certain banks.

Banks are negotiating with fintechs to address RBI's concerns, potentially pausing business for compliance.

This scrutiny follows the IIFL Finance debacle, highlighting RBI's strict compliance checks on fintech lending practices.

RBI canceled licenses of several fintechs, including a significant action against Paytm.

New regulatory guidelines introduced for fintechs aim at informing borrowers about potential lenders for informed decision-making.

RBI targets platforms like Paisabazaar, BankBazaar, CreditMantri, and Paytm for adherence to these guidelines.

Acemoney (India) lost its NBFC license due to irregular lending practices and non-compliance with digital lending operation norms.

RBI plans to establish DIGITA to regulate and curb illegal lending apps.

#citi #business #News #RBI #decision #valuation #money #war #B2G #digital #startup #bank

3. “Govt and Fintech Firms Tackle Cybersecurity & Digital Financial Fraud Together”

The finance ministry hosted a workshop discussing cybersecurity and digital financial fraud with fintech companies and law enforcement agencies.

Key topics included leveraging technology for financial access, combating money mules, real-time data breach surveillance, geotagging for tracing money trails, and modernizing digital infrastructure with IPv6 and API integration.

DFS Secretary Vivek Joshi emphasized the significant role of startups and fintechs in India's economic growth and called for greater collaboration across sectors.

Around 60 fintech firms, four fintech associations, and officials from various ministries and the Reserve Bank of India attended the workshop.

The initiative follows Finance Minister Nirmala Sitharaman's meeting with fintech startups stressing on norm compliance and consumer protection, leading to cybercrime issues being addressed in the upcoming Digital India Act.

Despite a funding winter, the Indian fintech sector remains vibrant, with over 726 startups raising more than $28 billion between 2014 and 2023, including notable fundraisings in the last year.

#consumer protection #technology #funding #billion #finance #News #money #B2G #digital #startup

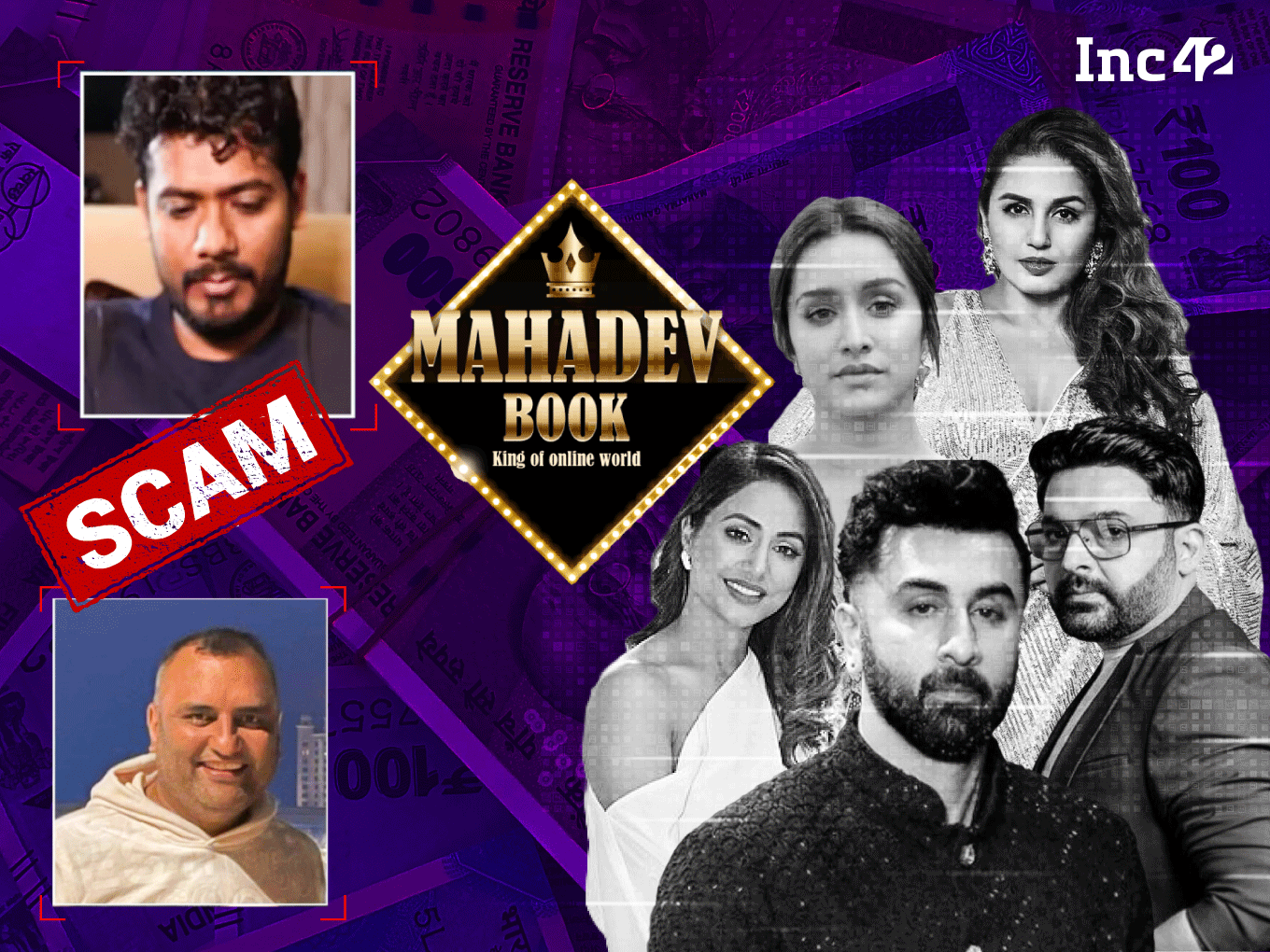

4. “Breaking News: ED Levels Up the Mahadev Betting App Investigation with New Chargesheet Against 25 Accused”

ED's Fresh Chargesheet in Mahadev Betting App Case: The Enforcement Directorate (ED) has filed a new chargesheet, naming 25 individuals and entities in the Mahadev online betting and gaming app money laundering investigation.

Involvement of High-ranking Figures: Allegations suggest the involvement of high-ranking politicians and bureaucrats from Chhattisgarh.

Key Accused Individuals: Girish Talreja, Suraj Chokhani, among others, are named; both were previously arrested by the ED.

Complex Money Laundering Network: The Mahadev app is accused of operating an umbrella syndicate for illegal betting websites, utilizing a network of benami bank accounts for money laundering.

Notable Actions by ED: A total of 11 individuals have been arrested, with major promoters detained in Dubai following an Interpol red notice.

Scandal Exposure: The scam gained significant attention after the lavish wedding of one of its promoters, Sourabh Chandrakar, in Dubai, featuring performances by numerous Bollywood stars.

Broader Implications: The case has led to questioning of multiple Bollywood celebrities and the detention of actor Sahil Khan by the Mumbai police crime branch after his anticipatory bail was rejected.

#gaming #News #money #B2G #moneylaundering #bank

5. “April's UPI Transactions Slightly Decline to 1.33 Billion: A Comprehensive Analysis”

UPI transactions slightly fell by 1% MoM to 13.30 Bn in April, from 13.44 Bn.

Year-on-year transaction count surged by 50%.

April's transaction volume reached INR 19.64 Lakh Cr, a slight decrease from March's INR 19.78 Lakh Cr but saw a 40% increase YoY.

RBI Governor Shaktikanta Das credited UPI for India's 46% contribution to global digital transactions, highlighting its 80% share in 2023's digital payments.

In 2023, UPI transaction number and value soared nearly 60% and over 40% YoY, respectively.

NPCI introduced UPI in various countries and launched features to boost UPI usage.

NPCI contemplates an interchange fee structure for UPI, aiming for lower rates than credit card transactions.

NPCI revises its stance on a 30% market share cap for UPI services, with the deadline set for December 2024.

#News #RBI #UPI #B2G #digital

NewsTok.ai is your ultimate destination for daily news briefs bringing you the latest in business, technology, startups, and politics. NewsTok curates & summary daily news summary from authentic sources, all powered by the best AI.

"In addition to English, we're excited to announce that our news articles are now available in both Tamil and Hindi on our website! We believe in making our content accessible to a wider audience, and by offering translations in these languages, we hope to engage and connect with even more readers. So whether you prefer to read in English, Tamil, or Hindi, you can enjoy our latest updates and insights on our website. Happy reading!"

Download our app (iOS / Android) or Join our WhatsApp Channel to stay ahead in just 5 minutes!